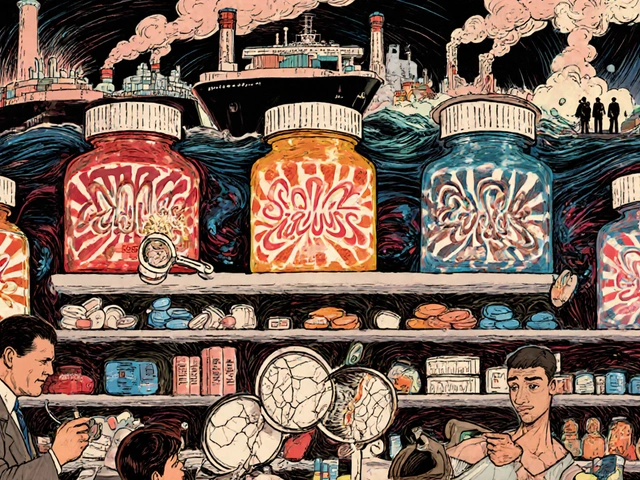

If you’ve ever stared at a pharmacy receipt and wondered how a small bottle of pills costs more than your grocery bill, you’re not alone. In 2026, millions of Americans still struggle with the real cost of prescriptions-even when they have insurance. The system isn’t broken because of one thing. It’s broken because of medication costs layered on top of each other: inflated list prices, confusing insurance rules, pharmacy benefit managers (PBMs) taking cuts, and a lack of transparency at every step.

Why Your Prescription Price Doesn’t Match the Label

The sticker price on a pill bottle? That’s the list price, set by the drugmaker. But that’s rarely what anyone actually pays. Behind the scenes, pharmacy benefit managers negotiate discounts with manufacturers, and insurers get rebates. The problem? You, the patient, often don’t see those savings. You’re stuck paying the full list price unless you use a coupon, switch to a generic, or fight through prior authorization. Take insulin, for example. A vial might list for $300. But thanks to Medicare price negotiations starting in January 2026, the same vial will cost Medicare beneficiaries no more than $35. That’s a drop of over 88%. But if you’re under 65 and on a private plan? You might still pay $100 or more-unless you use a manufacturer coupon or your pharmacy offers a discount program.How Generic Drugs Cut Costs Without Cutting Corners

Generic drugs aren’t second-rate. They’re exact copies of brand-name drugs, approved by the FDA to work the same way, in the same dose, with the same safety profile. The only difference? Price. Generics cost, on average, 80% to 85% less than their brand-name equivalents. In 2025, the average cost of a 30-day supply of a generic statin like atorvastatin was $8. The brand-name version, Lipitor, still cost $150-despite being off-patent for over a decade. That’s not a pricing error. That’s how the system works. Drugmakers extend patents, tweak formulations slightly, and keep charging premium prices while generics sit on the shelf, ready to save you money. Switching to generics isn’t always automatic. Your doctor might prescribe the brand name by habit. Ask for the generic. Pharmacists can often substitute unless the prescription says “dispense as written.” And if your insurance won’t cover the generic? Call your insurer. More than half the time, they’ll change their mind once you point out the cost difference.Prescription Coupons: The Hidden Discount That Might Not Help

You’ve seen them: “Save $50 on your next prescription.” These coupons, often from drugmakers, look like a lifeline. But they come with strings attached. Most manufacturer coupons only work if you have private insurance-and only if your plan doesn’t already cover the drug. If you’re on Medicare, Medicaid, or a government program, you can’t use them. That’s because federal rules ban drugmakers from giving discounts to programs that pay with taxpayer money. So if you’re on Medicare Part D, that $50 coupon? Useless. Even worse: some coupons are designed to keep you on expensive brand-name drugs. Instead of pushing you toward a cheaper generic, the coupon makes the brand feel affordable. That keeps the drugmaker’s profits high and delays the market entry of generics. In 2024, over $12 billion in manufacturer coupons were used-most for brand-name drugs with generic alternatives already available. The smarter move? Skip the coupon. Go straight to a discount pharmacy like Costco, Walmart, or Mark Cuban’s Cost-Plus Drugs. For common generics, you can often pay less than $5 without insurance. No coupon needed. No strings attached.

Prior Authorization: The Bureaucratic Hurdle That Delays Care

Prior authorization is when your insurance company says, “We won’t pay for this drug unless we approve it first.” Sounds reasonable, right? In theory, yes. In practice? It’s a nightmare. Your doctor submits paperwork. The insurance company takes 3 to 10 business days to respond. Meanwhile, your condition worsens. You miss work. You skip doses. You end up in the ER because you couldn’t get your medication on time. The worst part? Prior authorization is often used not for safety, but for cost control. Insurers will make you try a cheaper drug first-even if your doctor says it won’t work for you. For example, a patient with rheumatoid arthritis might be forced to try three cheaper biologics before the insurer will cover the one that actually helps. In 2025, a study by the American Medical Association found that 78% of physicians reported prior authorization delays caused harm to patients. Nearly 1 in 5 patients abandoned their prescriptions because of the hassle. The fix? Ask your doctor to submit the prior authorization request the same day they write the prescription. Call your insurer to find out what’s required upfront. And if they deny it? File an appeal. You have the right to challenge denials-and many are overturned on appeal.Medicare’s Big Changes in 2026: What You Need to Know

The biggest shift in U.S. drug pricing in 20 years started in January 2026. For the first time, Medicare is negotiating prices directly with drugmakers. The first 10 drugs chosen-mostly for diabetes, heart failure, and blood clots-now have capped prices. Medicare beneficiaries will pay no more than $35 per month for insulin and $2,000 total out-of-pocket for all prescriptions in a year. That $2,000 cap is huge. Before 2026, there was no limit. Some seniors paid over $6,000 a year just for meds. Now, once you hit $2,000, the rest is covered. No more “coverage gap” or donut hole. No more choosing between food and pills. The savings are real. The Congressional Budget Office estimates Medicare Part D enrollees will save an average of $400 per year. For someone on five or six prescriptions, that could mean hundreds saved monthly. But here’s the catch: these changes only apply to Medicare. If you’re under 65, you’re still stuck in the old system. That’s why state-level efforts matter. Minnesota now uses Medicare’s negotiated prices as a cap for Medicaid and private insurance. Other states are watching. If this works, it could become the new national standard.

What You Can Do Today to Lower Your Costs

You don’t have to wait for policy changes to save money. Here’s what works right now:- Ask for the generic version every time. Even if it’s not listed on your plan’s formulary, ask your pharmacist to check.

- Use GoodRx or SingleCare to compare cash prices at nearby pharmacies. Often, the cash price is lower than your insurance copay.

- Call your insurer’s pharmacy help line. Ask: “Is there a lower-cost alternative on your preferred list?”

- For chronic conditions, ask about 90-day supplies. Many insurers offer lower copays for longer prescriptions.

- If you’re on Medicare, check the Medicare Plan Finder tool. Your plan might change next year-and so might your costs.

- Never skip a dose because you can’t afford it. Talk to your doctor. There are patient assistance programs, charity funds, and drugmaker support programs you might qualify for.

Why This Matters Beyond Your Wallet

Medication costs aren’t just about money. They’re about health outcomes. When people can’t afford their prescriptions, they skip doses, split pills, or stop taking them entirely. That leads to hospitalizations, complications, and early death. A 2025 study in JAMA found that patients who couldn’t afford their heart medication were 30% more likely to be hospitalized within six months. Those who switched to generics had better adherence and fewer ER visits. The system is rigged to favor profits over people. But change is happening. Medicare’s price negotiations are the first real crack in the dam. Generics are still the most powerful tool in your pocket. And if you know how to ask the right questions, you can cut your drug bill in half-even without insurance.It’s not about being lucky. It’s about being informed. And right now, more information is available than ever before.

Can I use manufacturer coupons with Medicare?

No. Federal law prohibits drug manufacturers from offering coupons or discounts to Medicare, Medicaid, or other government programs. These coupons are only valid if you have private insurance and the drug isn’t already covered. If you’re on Medicare, skip the coupon and use the Medicare negotiated price or a discount pharmacy like Costco or Walmart.

Why is my generic drug more expensive than the brand name?

That shouldn’t happen. If your generic costs more than the brand, your insurance plan likely has a pricing error or is steering you toward a higher-cost pharmacy. Call your insurer and ask why. Often, switching to a different pharmacy or requesting a formulary exception will fix it. In 2025, over 60% of generic drug price discrepancies were resolved after patients appealed.

How long does prior authorization take?

Typically 3 to 10 business days, but urgent cases can be processed in 24 to 72 hours. If your condition is life-threatening or worsening, your doctor can request an expedited review. Keep a record of all calls and dates. If denied, file an appeal immediately-many approvals happen during the appeals process.

Are all generic drugs the same?

Yes, legally. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand name. They must also be bioequivalent-meaning they work the same way in your body. The only differences are inactive ingredients like fillers or dyes, which rarely affect effectiveness. If you notice a change in how a generic works, talk to your doctor. It could be a different manufacturer, not a quality issue.

What if I can’t afford my meds even with generics and coupons?

You’re not alone. Many drugmakers offer patient assistance programs that provide free or low-cost meds to those who qualify based on income. Nonprofits like NeedyMeds and the Partnership for Prescription Assistance can help you find programs. Local pharmacies sometimes have discount cards or charity funds. Never stop taking your meds without talking to your doctor-they may have samples, alternative prescriptions, or connections to support programs.

Akriti Jain

January 22, 2026 AT 08:44Mike P

January 23, 2026 AT 07:50Jasmine Bryant

January 24, 2026 AT 18:25Hilary Miller

January 25, 2026 AT 08:49Margaret Khaemba

January 27, 2026 AT 07:03Malik Ronquillo

January 27, 2026 AT 07:39Alec Amiri

January 28, 2026 AT 00:05Lana Kabulova

January 28, 2026 AT 21:43Rob Sims

January 30, 2026 AT 13:48arun mehta

January 30, 2026 AT 22:05Lauren Wall

January 31, 2026 AT 05:57Kenji Gaerlan

February 2, 2026 AT 02:36Oren Prettyman

February 3, 2026 AT 05:29Tatiana Bandurina

February 5, 2026 AT 04:55